The Auto Insurance Agent In Jefferson Ga PDFs

Wiki Article

Some Known Questions About Auto Insurance Agent In Jefferson Ga.

Table of ContentsThe Of Auto Insurance Agent In Jefferson GaMore About Life Insurance Agent In Jefferson GaHow Auto Insurance Agent In Jefferson Ga can Save You Time, Stress, and Money.Unknown Facts About Insurance Agent In Jefferson Ga

According to the Insurance Info Institute, the typical yearly cost for a car insurance coverage policy in the United States in 2016 was $935. 80. Usually, a solitary head-on collision can cost hundreds of dollars in losses, so having a plan will certainly set you back less than paying for the crash. Insurance also helps you stay clear of the decline of your automobile. The insurance safeguards you and helps you with cases that make against you in crashes. It also covers legal prices. Some insurance provider offer a no-claim benefit (NCB) in which eligible consumers can get approved for every claim-free year. The NCB might be used as a price cut on the premium, making vehicle insurance much more cost effective.

Numerous factors impact the expenses: Age of the car: Oftentimes, an older vehicle expenses less to guarantee contrasted to a more recent one. Brand-new vehicles have a higher market value, so they cost even more to repair or change.

Threat of theft. Specific vehicles frequently make the often taken checklists, so you could have to pay a higher premium if you possess among these. When it pertains to automobile insurance policy, the three primary kinds of plans are responsibility, crash, and comprehensive. Compulsory responsibility insurance coverage spends for damage to another driver's automobile.

Auto Insurance Agent In Jefferson Ga Things To Know Before You Get This

Some states call for motorists to carry this coverage (https://www.slideshare.net/jonportillo30549). Underinsured vehicle driver. Similar to uninsured insurance coverage, this policy covers problems or injuries you suffer from a driver that doesn't lug sufficient insurance coverage. Motorcycle insurance coverage: This is a policy especially for motorcycles due to the fact that car insurance does not cover motorcycle mishaps. The benefits of car insurance policy far surpass the dangers as you could wind up paying hundreds of bucks out-of-pocket for an accident you trigger.It's typically much better to have even more protection than inadequate.

The Social Protection and Supplemental Security Earnings disability programs are the biggest of a number of Government programs that give support to people with impairments (Business Insurance Agent in Jefferson GA). While these two programs are various in many ways, both are provided by the Social Protection Management and only people that have a disability and meet clinical standards may receive benefits under either program

Make use of the Advantages Eligibility Testing Device to figure out which programs may have the ability to pay you benefits. If your application has recently been denied, the Web Charm is a beginning factor to request an evaluation of our choice about your eligibility for impairment benefits. If your application is denied for: Medical reasons, you can complete and send the Charm Request and Charm Disability Record online. A subsequent evaluation of employees' payment insurance claims and the degree to which absenteeism, morale and working with great workers were problems at these companies shows the positive results of supplying health insurance coverage. When compared to organizations that did not use health and wellness insurance coverage, it appears that providing FOCUS caused renovations in the capacity to employ good employees, reductions in the variety of employees' compensation cases and decreases in the degree to which absenteeism and productivity were problems for emphasis businesses.

The 6-Second Trick For Business Insurance Agent In Jefferson Ga

6 records have been released, consisting of "Care Without Insurance Coverage: Insufficient, Too Late," which locates that working-age Life Insurance Agent in Jefferson GA Americans without health insurance coverage are most likely to obtain insufficient treatment and receive it far too late, be sicker and die faster and get poorer treatment when they are in the hospital, even for intense situations like a motor automobile crash.The research authors also keep in mind that expanding coverage would likely lead to a rise in genuine source expense (no matter that pays), because the without insurance receive regarding fifty percent as much treatment as the privately insured. Health Affairs released the research study online: "Exactly How Much Treatment Do the Uninsured Usage, and Who Spends for It? - Business Insurance Agent in Jefferson GA."

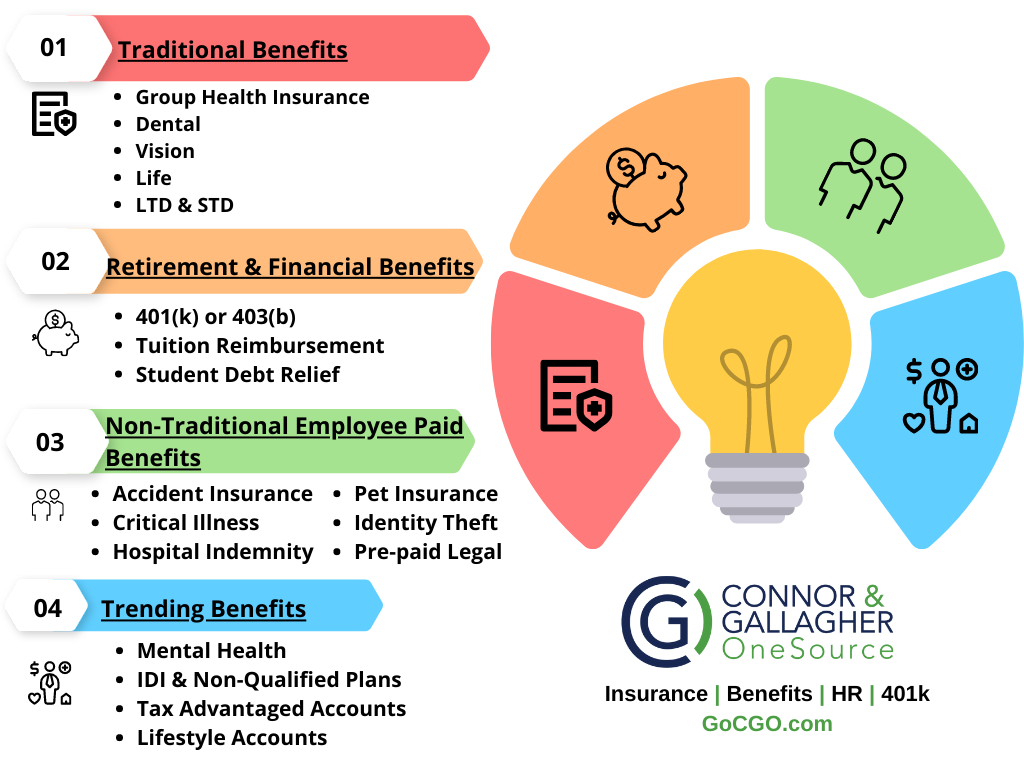

The responsibility of offering insurance policy for staff members can be a complicated and often expensive job and numerous little companies assume they can not manage it. What advantages or insurance do you legally require to offer?

Not known Incorrect Statements About Business Insurance Agent In Jefferson Ga

Fringe benefit usually start with medical insurance and team term life insurance policy. As part of the medical insurance plan, an employer might decide to provide both vision and dental insurance. None of these are required in many states, companies supply them to continue to be affordable. The majority of potential employees aren't going to work for a company that doesn't supply them accessibility to standard medical care.

With the rising fad in the price of medical insurance, it is reasonable to ask staff members to pay a portion of the protection. A lot of organizations do put most of the cost on the employee when they supply accessibility to wellness insurance policy. A retirement strategy (such as a 401k, easy strategy, SEP) is normally offered as a worker benefit too - https://www.40billion.com/profile/141233372.

Report this wiki page